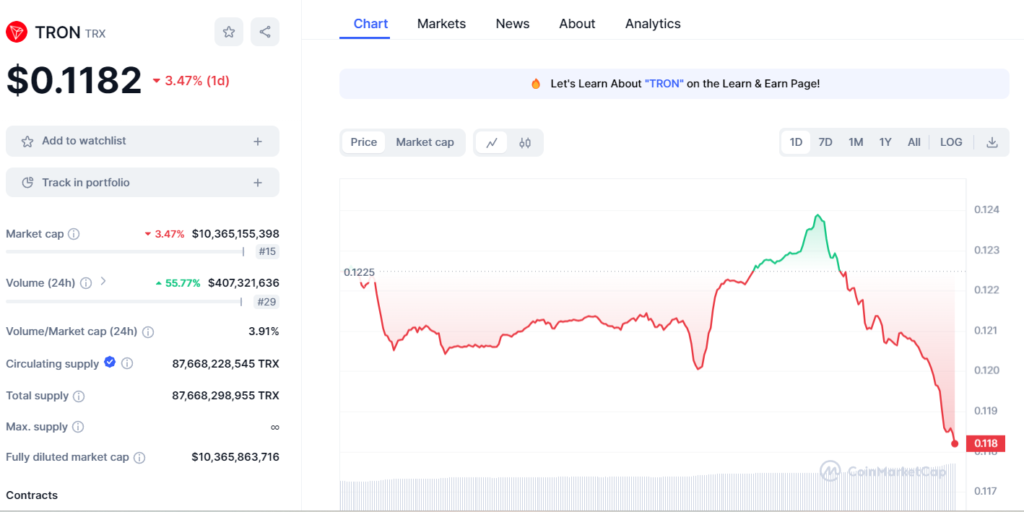

TRON has experienced a significant decrease in value, declining by over 16% in the past 30 days. Despite this, it remains a prominent player in the cryptocurrency space, holding the 16th position by market capitalization. As per the latest data, TRON (TRX) boasts a market cap exceeding $10.2 billion, with a 24-hour trading volume of $300 million, reflecting an 18.59% decrease.

The circulating supply of TRON is 87,707,510,948 TRX, slightly lower than its total supply of 87,707,543,397 TRX.

Weekly Perspective:

From a weekly technical standpoint, TRON has been trading bearishly since encountering resistance at the 0.1451 level in March. Although the previous week showed some bullish activity amidst the overall bearish trend, this week’s trading has seen TRON’s price dip below last week’s close, indicating a potential continuation of the bearish trend. The next support level is marked by an ascending trendline or a horizontal support level indicated in blue if a successful breakdown occurs below the current market price.

Daily Outlook:

Since March 6th, 2024, TRON’s prices have been in a bearish trajectory following rejection at the 0.1450 resistance zone. However, on March 19th, the price found support at an ascending trendline and has since rebounded, establishing a new resistance level around 0.1230. Currently, TRON’s price on the daily chart is approaching the ascending trendline zone, with consolidation observed over the past two days. If bears regain control and the ascending trendline breaks down, prices may drop further to test recent lows at 0.1104 or horizontal support levels at 0.1082.

The daily Relative Strength Index (RSI) stands at 40.35, suggesting that continued price declines and testing of support levels could potentially lead the RSI into oversold territory, hinting at a possible bullish reversal in the near future.

4-Hour Perspective:

On the 4-hour chart, TRON’s price is consolidating, similar to the daily chart. However, bearish momentum is evident, with the asset testing the ascending trendline below it after breaking down from the lower timeframe ascending trendline on April 1st, 2024. TRON appears to have formed a ranging channel on the 4-hour chart, with immediate support lying at around 0.1155, coinciding with the support of the ranging channel and the ascending trendline below it. Traders are closely monitoring TRON’s ability to hold this critical level or experience further downside correction.